## Forex and Global News (Last 8 Hours)

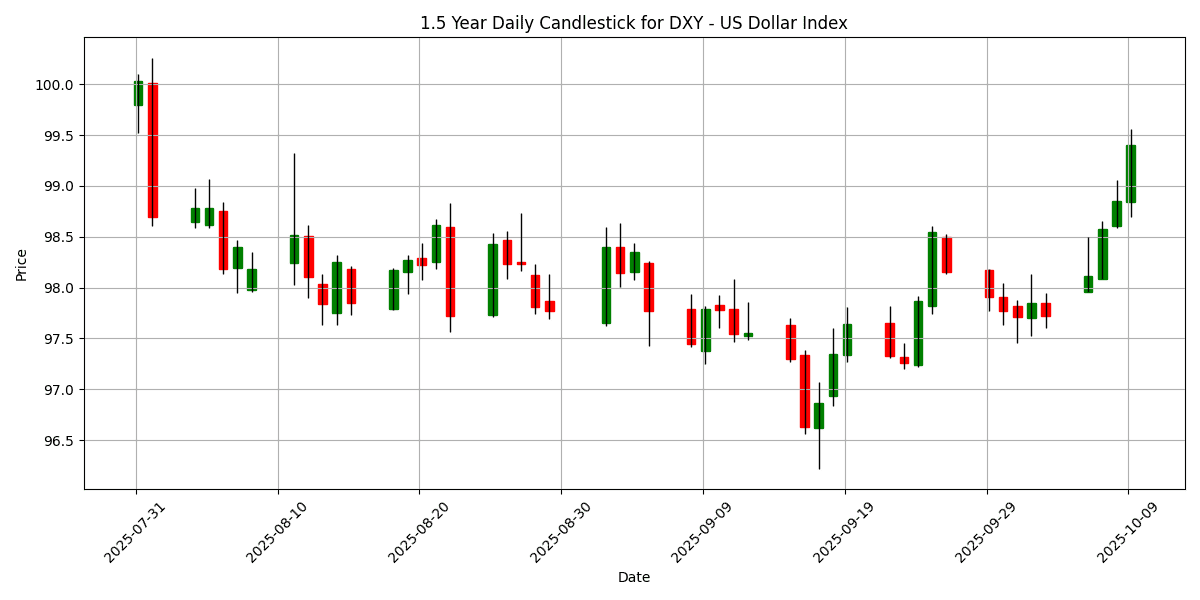

In the latest forex market developments, the US Dollar (USD) surged, contributing to a broad strengthening of the Greenback across G7 currencies. The Canadian Dollar (CAD) fell over 0.5% against the USD, reflecting a significant uptick in demand for the Greenback. Similarly, the Australian Dollar (AUD) declined, breaking below the critical 0.6600 level as the USD Index (DXY) climbed to fresh two-month highs above 99.00.

The Euro (EUR) continued its downward trend, with the EUR/USD pair slipping to the mid-1.1500s, nearing nine-week lows, while the Yen (JPY) steadied around 153.00, marking its sixth consecutive day of losses. Gold prices also retreated sharply, plunging below $4,000 to $3,978, as profit-taking and USD strength dominated market sentiment.

Overall, the market sentiment remains risk-averse, with traders cautious amid global uncertainties. The DXY is currently at 99.40, reflecting a daily change of 0.6858%.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-09 | 02:00 | 🇪🇺 | Medium | German Trade Balance (Aug) | 17.2B | 15.1B |

| 2025-10-09 | 03:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-09 | 06:00 | 🇪🇺 | Medium | Eurogroup Meetings | ||

| 2025-10-09 | 07:30 | 🇪🇺 | Medium | ECB Publishes Account of Monetary Policy Meeting | ||

| 2025-10-09 | 08:00 | 🇨🇦 | Medium | BoC Senior Deputy Governor Rogers Speaks | ||

| 2025-10-09 | 08:00 | Medium | CPI (YoY) (Sep) | 5.17% | 5.22% | |

| 2025-10-09 | 11:00 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-10-09 | 18:00 | 🇦🇺 | Medium | RBA Assist Gov Kent Speaks |

On October 9, 2025, key economic events are poised to impact G7 FX markets significantly.

The German Trade Balance for August reported a surplus of €17.2 billion, exceeding expectations of €15.1 billion. This positive surprise may bolster the euro (EUR) as it indicates stronger-than-anticipated export performance, potentially leading to upward pressure on the currency against peers like the US dollar (USD) and British pound (GBP).

At 06:00, the Eurogroup Meetings will commence, where discussions on fiscal policies and economic strategies within the Eurozone could influence market sentiment towards the EUR. Following this, at 07:30, the ECB will publish the account of its recent monetary policy meeting, which may provide insights into future interest rate decisions and economic outlook, further affecting EUR volatility.

Additionally, speeches from ECB officials, including Lane at 11:00 and Balz at 03:00, are expected to offer guidance on monetary policy stances, potentially impacting EUR trading dynamics.

In Canada, the BoC Senior Deputy Governor Rogers will speak at 08:00, which may provide clues on the Bank of Canada’s monetary policy outlook, influencing the Canadian dollar (CAD).

Overall, these events are critical for traders, as they could lead to significant currency fluctuations in the G7 FX landscape.

## G7 Currency Pairs Performance

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1569 | -0.5758 | -1.3315 | -1.4067 | -1.7005 | -1.1429 | 2.7640 | 11.17 | 5.4052 | 1.1688 | 1.1632 | 1.1201 | 28.77 | -0.0013 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 153.07 | 0.3613 | 4.0258 | 4.0732 | 3.8748 | 4.6388 | 6.4885 | -2.4975 | 3.3174 | 148.01 | 146.72 | 148.29 | 72.01 | 0.9100 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3304 | -0.7609 | -1.0608 | -1.3069 | -1.8378 | -2.0293 | 2.4009 | 6.0156 | 1.5973 | 1.3469 | 1.3500 | 1.3156 | 33.46 | -0.0028 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8062 | 0.5990 | 1.1518 | 1.1658 | 1.6889 | 1.1899 | -1.7740 | -10.7435 | -5.9715 | 0.8009 | 0.8045 | 0.8403 | 69.28 | 0.0001 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6557 | -0.5159 | -0.6228 | -0.8843 | -0.6228 | -0.5611 | 5.3605 | 5.4180 | -2.7093 | 0.6550 | 0.6533 | 0.6417 | 39.47 | 0.0006 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4018 | 0.4947 | 0.4090 | 0.5631 | 1.6165 | 2.6486 | 0.4803 | -2.3122 | 2.6809 | 1.3832 | 1.3762 | 1.3986 | 83.92 | 0.0048 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5747 | -0.7255 | -1.2459 | -1.2849 | -3.3320 | -4.8780 | -0.0154 | 1.9024 | -6.2693 | 0.5884 | 0.5947 | 0.5845 | 28.73 | -0.0032 |

| DXY – US Dollar Index | DXY | 99.40 | 0.6858 | 1.7192 | 1.5841 | 1.6464 | N/A | N/A | N/A | N/A | 98.05 | 98.05 | 98.05 | 69.73 | 0.1915 |

## Charts

## Technical Analysis

In the current analysis of G7 currency pairs and the DXY, several key technical indicators highlight potential trading opportunities.

Starting with EUR/USD, the pair is currently in an oversold condition with an RSI of 28.77, suggesting a possible reversal. The MACD is negative at -0.0013, indicating bearish momentum, while price remains below the 50-day (1.1688) and 100-day (1.1632) moving averages, reinforcing the bearish outlook.

Conversely, USD/JPY shows strong bullish momentum with an RSI of 72.01, suggesting overbought conditions. The MACD at 0.9100 supports this bullish trend, and the price is well above the 50-day (148.0095) and 100-day (146.7223) MAs, signaling potential for a pullback.

USD/CAD is also in overbought territory with an RSI of 83.92, and a positive MACD of 0.0048, indicating strong upward momentum. Traders should watch for potential exhaustion signals.

The DXY, with an RSI of 69.73 and a positive MACD of 0.1915, suggests continued strength in the U.S. dollar, potentially impacting the aforementioned pairs.

Overall, traders should be cautious in overbought scenarios while looking for reversal opportunities in oversold pairs like EUR/USD and NZD/USD.

—

**Disclaimer:** The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.