On Friday, Asian equity markets and bond yields fell, while safe-haven assets such as gold, crude oil, and certain currencies saw gains, following reports that Israel had launched attacks on a military base in Iran. This raised alarm over the potential escalation into a more extensive Middle Eastern conflict. Market reactions were initially sharp, but moderated after it became clear that the Israeli operations were limited and Iranian officials denied any missile attacks on their territory. This news arrived just hours after Netflix Inc. announced robust earnings for the first quarter, yet its shares were weak in post-market trading.

Yesterday’s market performance closed with mixed movements across major indices. The Dow Jones Industrial Average experienced a slight increase, ending the day up by 22.07 points, a modest gain of 0.06%. Meanwhile, the S&P 500 saw a decrease, down by 11.09 points, which translates to a 0.22% drop. The Nasdaq Composite faced a more significant decline, falling 81.87 points, or 0.52%, by the closing bell.

The Asian session performance was more negative due to both technical and geopolitical factors. The Nikkei 225 led the losses, plunging 964 points, which amounted to a significant 2.53% drop. The Hang Seng Index also faced a downturn, shedding 140.05 points, closing down by 0.85%. The Shanghai Composite index had a more contained decline, with a modest fall of 8.96 points, translating to a 0.29% dip.

In the current trading session, European stock indices are experiencing a downward trend. The Euro Stoxx 50 has declined by 37.92 points, a drop of 0.77%. Germany’s DAX is also facing losses, presently down by 161.06 points, which marks a 0.90% decrease. The FTSE 100 in the UK is trading lower by 40.99 points, a reduction of 0.52%. Meanwhile, the CAC 40 in France is showing a decline of 47.73 points, equivalent to a 0.59% fall.

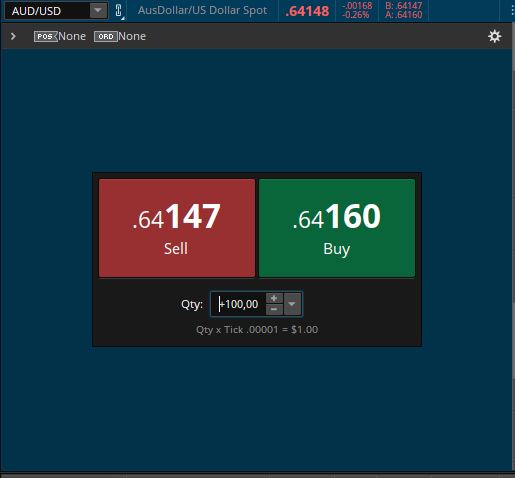

The forex market is showing varied movements across major currency pairs. The EUR/USD is modestly higher, quoting at 1.0653, marking an increase of 0.08%. The USD/JPY is pricing at 154.4, reflecting a decline of 0.16%. The GBP/USD is slightly up, with a quoting price of 1.2441, a gain of 0.03%.The USD/CHF is quoting lower at 0.9082, down by 0.45%. Similarly, the USD/CAD pair is pricing at 1.3758, indicating a small decrease of 0.06%. The AUD/USD is slightly down, with a quoting price of 0.6418, a 0.04% reduction. Lastly, the NZD/USD is trading at 0.5892, experiencing a decline of 0.17%.

Precious metals are witnessing an uptick. Gold is trading at $2,383.62, which is a 0.20% increase, while silver (XAG/USD) is at $28.3425, up by 0.37%.

For the energy sector, West Texas Intermediate (WTI) Crude Oil is pricing at $82.94, with a marginal increase reflected in the change percentage of 0.0025. Brent Oil is also seeing a slight rise, currently at $87.25, a change percentage of 0.0016. Both oil benchmarks show relatively stable trading conditions with modest changes in the session despite the spike during the Asian session triggered by Israel response to Iran missile attacks of last Sunday. Bitcoin (BTC) is valued at $64,481.11, showing a decline of 0.86%. Ethereum (ETH), meanwhile, is priced at $3,100.69, with a decrease of 1.10%.