Precious Metals Update: Gold Edges Higher 0.62% – RSI at 50

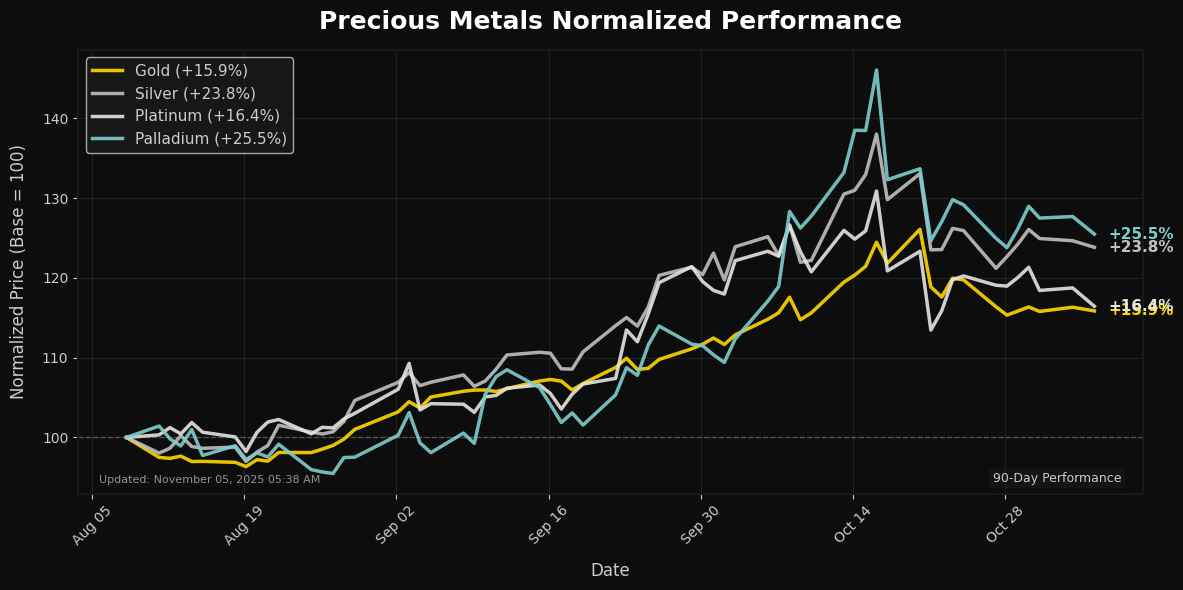

📊 Market Overview

Report Date: November 05, 2025

| Metal | Price | Daily Change (%) | MA21 | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|

| Gold | $3984.30 | +0.62% | $4069.94 | $3840.64 | $3594.87 | $3346.74 | 50.28 | 38.15 |

| Silver | $47.57 | +0.58% | $48.58 | $45.29 | $41.39 | $37.15 | 50.85 | 0.57 |

| Platinum | $1543.50 | -0.46% | $1608.03 | $1516.58 | $1437.86 | $1220.53 | 46.68 | 8.49 |

| Palladium | $1422.00 | +0.11% | $1466.99 | $1306.23 | $1234.78 | $1101.85 | 51.65 | 31.95 |

🔸 Gold

Technical Analysis

As of the latest data, Gold is trading at $3984.30, reflecting a daily increase of 0.62%. The price is currently positioned below the 21-day moving average (MA21) of $4069.94, indicating a potential resistance zone. The 50-day moving average at $3840.64, however, serves as a critical support level, suggesting that price movements could stabilize around this mark if bearish pressure continues.

The RSI at 50.28 indicates a neutral stance, reflecting a balance between buying and selling momentum. Coupled with a MACD of 38.15, which signals bullish pressure, there is potential for a reversal if Gold can break above the MA21. In the broader context, long-term moving averages (MA100 and MA200) suggest a robust bullish trend, providing further support for the overall bullish outlook. Traders should watch key levels closely as Gold navigates this critical price zone, with potential for upward correction if momentum gains traction.

🔸 Silver

Technical Analysis

Silver is currently trading at $47.57, reflecting a modest daily change of 0.58%. The price remains above its 21-day moving average (MA21) of $48.58, indicating a potential short-term bullish sentiment, but it has yet to overcome this critical resistance level. Support is evident near the 50-day moving average (MA50) at $45.29, which could provide a floor if prices retreat.

The Relative Strength Index (RSI) is at 50.85, suggesting that silver is neither overbought nor oversold, indicating a neutral momentum. Meanwhile, the MACD (0.57) signals that bullish momentum may be gaining traction, although it remains below the zero line, reflecting a cautious outlook.

Overall, silver is at a pivotal point—traders should closely monitor the $48.58 resistance level for signs of a breakout while keeping an eye on $45.29 for support, as these could dictate short-term market movements.

🔸 Platinum

Technical Analysis

Platinum is currently trading at $1543.50, reflecting a daily change of -0.46%. The prices are situated between key moving averages, with MA21 at $1608.03 acting as a potential resistance level and the MA50 at $1516.58 providing near-term support. The more extended-term trend shows a bullish inclination with the MA100 at $1437.86 and MA200 at $1220.53, indicating overall upward momentum since these averages are substantially lower.

The RSI at 46.68 suggests that platinum is nearing equilibrium, showing no strong overbought or oversold conditions. Meanwhile, the positive MACD value of 8.49 indicates that the short-term momentum may still be favorable, yet lacks significant strength to assure a bullish breakout.

In conclusion, while immediate resistance exists near $1608, the broader trend remains constructive. Traders should monitor for consolidation around current levels, with potential long opportunities if price action convincingly breaks above the MA

🔸 Palladium

Technical Analysis

As of the latest analysis, Palladium is trading at $1422.00, reflecting a modest daily change of 0.11%. The current price is situated below the 21-day moving average (MA21) of $1466.99, indicating potential resistance at this level. Conversely, the 50-day (MA50) at $1306.23 and the 100-day (MA100) at $1234.78 provide critical support levels, suggesting a foundational strength should the price retreat.

The Relative Strength Index (RSI) at 51.65 indicates neutral momentum, suggesting that Palladium is neither overbought nor oversold, which is consistent with its slight upward movement in the MACD at 31.95. This suggests ongoing bullish potential if momentum picks up.

Overall, while Palladium currently faces resistance near the MA21, should it break above $1467, bullish sentiments may gain traction, leading to further gains. Conversely, support at MA50

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.