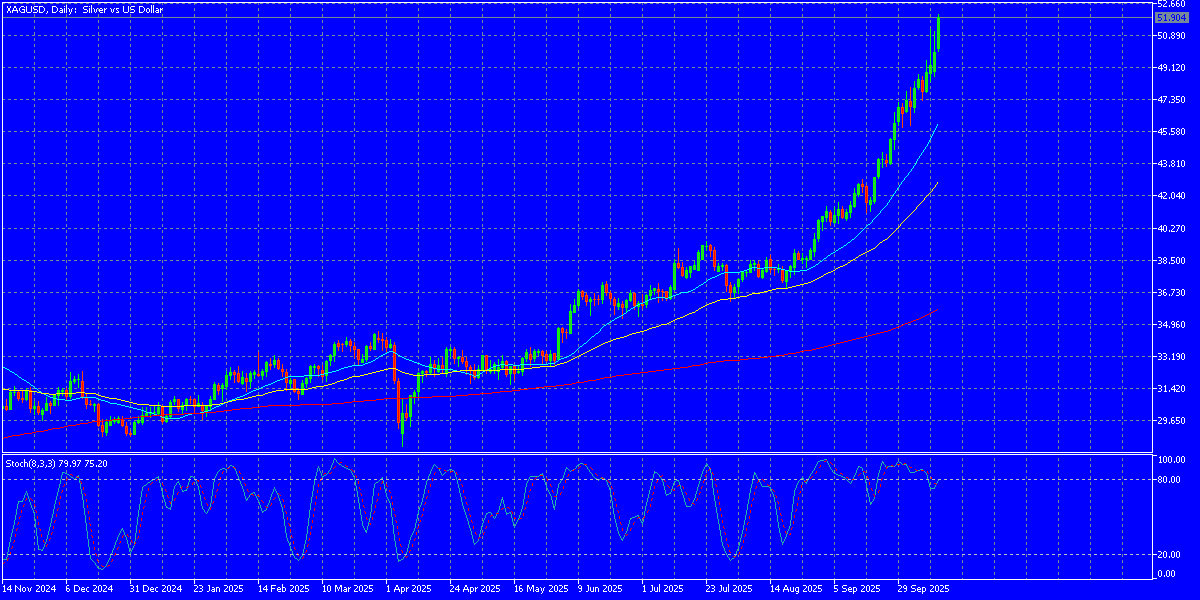

As of October 13, 2025, the silver market is experiencing unprecedented volatility, with prices surging toward the $50 per ounce milestone amid industrial demand, supply shortages, and geopolitical uncertainties.

This rally has prompted regulatory and market responses, including margin increases by the CME Group for futures trading. While over-the-counter (OTC) derivatives like silver swaps have not seen confirmed widespread hikes, experts warn that rising volatility could lead to higher collateral requirements and swap rates in the OTC space. This article explores these developments, their causes, and implications for traders and investors.

The Silver Surge: A Volatile Landscape

Silver prices have climbed over 25% year-to-date in 2025, driven by robust demand from sectors like solar energy, electronics, and electric vehicles, coupled with persistent supply deficits estimated at 150 million ounces for the year. Recent backwardation—where spot prices exceed futures by as much as $2.50 (5%)—signals physical shortages and strains in the market. Volatility has intensified, with daily price swings potentially escalating from $1–$2 to $5–$10 as liquidity thins.

This environment has led to record trading volumes on the CME, with October 9, 2025, marking a historic high, primarily fueled by precious metals activity. Speculative long positions in silver futures are at three times their five-year average, per CFTC data, heightening risks of sharp corrections.

CME Margin Increases: Curbing Speculation

To manage these risks, the CME Group has implemented multiple margin hikes for silver futures (SI contract) in late 2025. These adjustments require traders to post more collateral, aiming to reduce leverage and prevent excessive speculation.

Key changes include:

- September 26, 2025: Initial margin increased by approximately 6.67% as part of a broader precious metals adjustment. This followed similar moves for gold (6.25%) and addressed backwardation and physical demand pressures.

- October 10, 2025: A further hike effective immediately, raising overnight initial margins from $16,000 to $17,500 per contract—a 9.4% increase. Maintenance margins followed suit, while day-trade margins remained lower (around $2,000–$3,000 for micro contracts). This was announced on October 9, 2025, via CME notice, coinciding with peak volatility.

These hikes echo historical precedents, such as the 84% increase in 2011 that temporarily capped silver near $50. Brokers like Interactive Brokers and NinjaTrader have relayed these changes to clients, enforcing them for overnight positions. Despite the increases, silver prices rebounded post-announcement, indicating resilient bullish sentiment.

| Date | Margin Type | Previous Amount | New Amount | % Increase | Rationale |

|---|---|---|---|---|---|

| Sep 26, 2025 | Initial | Not specified | Increased | 6.67% | Address backwardation and demand tightness. |

| Oct 10, 2025 | Initial (Overnight) | $16,000 | $17,500 | 9.4% | Manage volatility and record volumes. |

Analysts suggest further adjustments could occur if prices breach $50, potentially forcing liquidations among leveraged traders.

Potential Swaps Increases in OTC Derivatives

While CME-regulated futures have seen explicit margin hikes, the OTC derivatives market—encompassing silver forwards, total return swaps, and commodity swaps—operates differently. OTC trades are often bilateral or cleared through entities like CME Clearing for precious metals, subject to regulations under Dodd-Frank.

No widespread confirmed increases in OTC swap rates or collateral have been reported as of October 13, 2025. However, rising volatility could indirectly drive changes:

- Collateral Requirements: For uncleared OTC derivatives, initial and variation margins are mandated under global standards (e.g., EMIR, Dodd-Frank). A May 2025 review by the Financial Markets Standards Board highlighted inefficiencies in uncleared margins, suggesting potential for higher collateral demands amid volatility. Cleared OTC silver swaps might align with CME futures margins, leading to de facto increases.

- Swap Rates and Costs: Overnight financing rates (swaps) for CFDs or spot positions remain tied to benchmarks like SOFR plus spreads (around 5.5% annualized). Brokers report no silver-specific hikes, but wider bid-ask spreads and liquidity premiums (e.g., $2.70–$4 under spot for buybacks) reflect caution. If volatility persists, swap rates could rise to compensate for risk, similar to implied volatility spikes in gold and silver options.

Market participants, including major banks with significant gold and silver derivatives exposure, face systemic risks from these positions. Projections indicate volatility risks escalating in 2025 due to tariffs and economic factors, potentially prompting OTC counterparties to demand more collateral.

Discussions on platforms like X highlight trader concerns over potential “margin calls” extending to OTC markets, though no concrete actions have materialized yet.

Implications for Market Participants

These developments underscore the double-edged sword of silver’s bull run. For retail traders, higher margins mean reduced leverage and possible forced liquidations, while institutions may shift to OTC for flexibility—but at the risk of rising costs. Physical silver premiums remain elevated, offering an alternative for long-term holders.

Looking ahead, if supply crunches worsen (e.g., mining disruptions), volatility could intensify, triggering more adjustments. Experts predict silver could test $40–$50 by year-end, but warn of pullbacks if margins continue to rise.

Traders are advised to monitor CME notices daily, maintain excess collateral (20%+ buffer), and consider diversified exposure. As the market evolves, balancing risk management with opportunity will be key in this volatile silver landscape.