Investing and trading often revolve around metrics such as returns, dividends, and valuations. While these are essential aspects to consider, the concept of ‘drawdown’ holds equal, if not more, importance in assessing the risk and performance of a financial strategy. In this article, we’ll delve into why drawdown is paramount in trading and investing, illustrating its significance with relevant examples.

What is Drawdown?

Drawdown refers to the peak-to-trough decline during a specific recorded period of an investment. In simpler terms, it is the highest drop in value an investment portfolio has witnessed from its peak before finding a bottom. It’s a measure of downside volatility and potential loss an investor might endure.

For instance, if a portfolio starts at $1,000, grows to $1,500, and then drops to $1,200, the drawdown is 20%. This is calculated as ($1,500 – $1,200) / $1,500 = 0.20 or 20%.

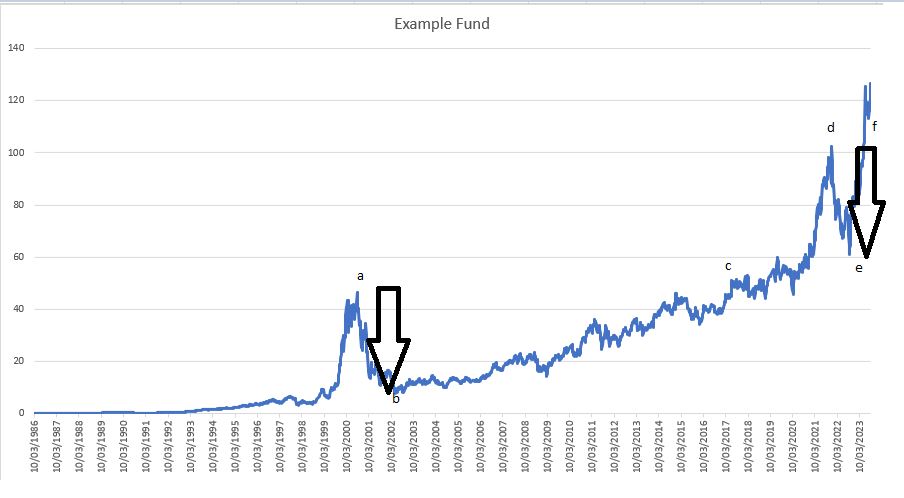

In the chart below , a random generated virtual fund was created as example, the Example Fund

if considering 1999 as the starting point the first Drawdown was created from point a (top) to point b (bottom) with a decrease of more than 50%, and it took almost 15 years ! to reach the same price level , in point c. There are of course other implications (like high-water marks but this will be covered in another article), but is clear that without DD (Drawdown) under control, consequences can be painful financially and psychologically as well. Continuing with the Example Fund, most recent DD was from point d to point e, quite a sharp and fast selloff of almost 50% again during 2021-2022 but on point f, a few months ago, it reached the previous peak.

Why is Drawdown paramount?

Realistic expectations and psychological preparedness: No one enjoys seeing their portfolio decline in value. Drawdown helps set realistic expectations. By understanding the potential drawdowns of an investment or trading strategy, an investor can be better mentally prepared for inevitable downturns.

Example: John invests in a strategy that historically has had a maximum drawdown of 25%. Knowing this, he doesn’t panic when his portfolio drops by 20%, understanding that such declines are within expected boundaries.

Risk management and portfolio allocation: By gauging the historical or potential drawdown of an asset or strategy, investors can make more informed decisions about risk management and portfolio allocation.

Example: Emily, an investor, splits her portfolio between two funds: Fund A with a historical drawdown of 10% and Fund B with a 30% drawdown. If she wants to limit her portfolio’s overall risk, she might allocate a larger portion to Fund A.

Performance benchmarking: Drawdowns provide a lens to assess and compare the risk-adjusted performance of different assets or strategies. While two strategies might offer similar returns, the one with a lower drawdown is generally considered less risky.

Example: Two hedge funds offer an annual return of 15%. Fund X has a maximum drawdown of 10%, while Fund Y has a drawdown of 20%. An investor focusing on risk-adjusted performance might opt for Fund X due to its lower drawdown, signifying reduced volatility and potential loss.

Recovery insights: Understanding drawdown also informs about the time and performance required to recover losses. A 50% drawdown requires a 100% return to break even, which might be challenging and time-consuming.

Example: Alex’s portfolio undergoes a 50% drawdown, decreasing from $100,000 to $50,000. He will now need a 100% return on his current portfolio value to return to the initial amount.

Drawdown Limitations

While drawdown provides invaluable insights into potential losses, it’s also crucial to recognize its limitations:

Past performance ≠ Future results: A past maximum drawdown doesn’t guarantee that future drawdowns will remain within the same limit. Market conditions evolve, and the unpredictability of financial markets can lead to unprecedented drawdown levels.

Frequency matters: An investment might have a lower maximum drawdown but experience frequent significant drawdowns, which can be more detrimental than a one-time larger drawdown.

Dependence on time frame: The significance of drawdown varies based on the evaluation period. A strategy might exhibit high drawdowns in the short term but lower ones over a more extended period, or vice versa.

Conclusion

The allure of high returns often overshadows the inherent risks in trading and investing. Drawdown, as a metric, brings those risks into the spotlight, ensuring that investors and traders are not blindsided by potential declines in portfolio value. It’s an essential tool, not just for performance assessment but also for shaping investor psychology, portfolio management decisions, and risk evaluation.

While the siren song of high returns will always be tempting, prudent investors understand that safeguarding their capital and being aware of potential pitfalls, as highlighted by drawdowns, is equally, if not more, crucial for long-term financial success.