In the age of digital financial markets and online investment platforms, opening a brokerage account has become easier than ever. However, the convenience factor should not lull potential investors into complacency. Before taking the plunge, it’s imperative to perform due diligence to ensure the integrity, safety, and suitability of the chosen brokerage.

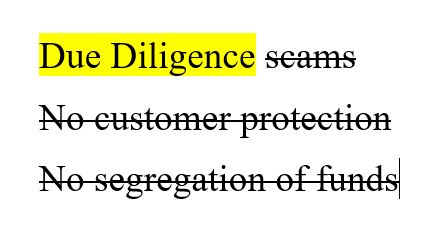

Due diligence should be part of any investors or traders toolbox because a sounding due diligence function is to prevent scams, regulatory issues and bad reputation. Sometimes, despite the financial intermediary has other kinds of problems, which are technical like poor platform or customer service performance when needed. Risk Management and due diligence go hand in hand and investors should make an effort to make some research before depositing hard earned money on a broker.

There are some country specific guidelines of course, since the categorisation for being considered professional investor is not the same or laws regarding segregation of customers funds may depend on local framework.

The following is a guideline to due diligence before to open a brokerage account, worth noting however that both markets and intermediaries are dynamic thus special events, both external and internal of an organisation may require an enhanced due diligence and then monitoring.

Regulatory Oversight:

The primary thing to look for is whether the broker is regulated by a recognized financial authority. Regulatory agencies oversee the practices of financial firms and ensure they adhere to laws and standards designed to protect investors. Some top regulatory bodies include:

The U.S. Securities and Exchange Commission (SEC)

The Financial Industry Regulatory Authority (FINRA)

Commodity Futures Trading Commission (CFTC)

The UK’s Financial Conduct Authority (FCA)

The Australian Securities and Investments Commission (ASIC)

These agencies not only set guidelines but also monitor brokers for compliance, ensuring that they act in the best interests of their clients.

If a broker is not regulated because it is operating from a jurisdiction from where a licence is not needed, frequently used by certain Forex and Crypto services, it is required an extra effort to really understand if really worth opening an account with these firms.

These firms cannot offer their services to residents of certain countries, but if they do anyway there are risks that in the most fortunate cases are hefty fines to pay as settlement by the service provider. Customer protection of course is much lower, almost zero, on not regulated brokerages thus there is not that much that can be done in case of scams, default of the broker, or simply website going offline.

Historical Performance and Past Indiscretions:

Even if a broker is regulated, it’s important to check its track record. A simple online search can yield a wealth of information. Here are a few things to keep an eye on:

Past Fines or Penalties: Has the broker been fined or penalized for any wrongdoing in the past? If so, it’s crucial to understand the reasons behind such actions.

Client Reviews and Testimonials: While online reviews should be taken with a grain of salt, recurring issues or complaints can be a red flag.

Financial Statements (when the firm is a public listed company): A broker’s financial stability can be a good indicator of its reliability. Reviewing their financial statements can give insights into their overall health.

Beware of Social Media and Sponsored Content:

The influence of social media and influencer marketing cannot be understated in today’s digital age. Here’s how to navigate this terrain:

Spotting Sponsored Content: Many influencers are paid to promote specific platforms. While this isn’t inherently negative, it’s essential to recognize promotional content and differentiate it from genuine reviews.

Sometimes is very difficult to understand if a broker or platform is genuinely compared or is a promo. When advertising is hidden , where the influencer does not disclose that has received compensation for mentioning a broker, things are not really at the best standard, thus is not a good signal.

Sports or Hollywood celebrities while help to build a brand , do not know that much usually about what is going on behind the curtains of a financial business. While the endorsement from a sports celebrity or a famous actor does not mean anything bad it is paramount that confidence on celebrities does not substitute personal due diligence and judgement.

Avoiding Confirmation Bias: It’s easy to gravitate toward opinions that align with our pre-existing beliefs. Be wary of this bias and actively seek out diverse perspectives to make an informed decision.

Looking Beyond Viral Content: A viral post or video can significantly sway opinions. However, these tend to capture attention because they’re sensational, not necessarily because they’re the most informed or accurate.

Fees and Costs:

Each broker has its fee structure. Before opening an account, understand the costs associated with trading, account maintenance, and other potential fees. Ensure that these costs align with your investment strategy and budget.

Trading Platforms and Tools:

Not all brokerage platforms are created equal. Check whether the broker offers a user-friendly interface, robustness during peak connectivity, comprehensive research tools, and responsive customer support. If possible, opt for demo accounts or trials to get a feel for the platform but demo conditions do not get the same data load of real one since demo platform is not connected to exchanges or liquidity providers but usually to bridges where administrators can make settings almost custom made.

Conclusion:

Investing is not just about market research and making astute decisions; it’s also about choosing the right partner in the form of a trustworthy broker. By conducting thorough due diligence, you lay the foundation for a safer, more informed, and potentially more profitable investment journey.

Reading all the Terms and Conditions before opening an account is a boring experience that not all brokerage customers do but is an healthy exercise to do that would avoid some disappointment and stress in the future.