In a decision that underscores the Monetary Policy Committee’s (MPC) razor-thin margin for error, the Bank of England today opted to keep its benchmark Bank Rate unchanged at 4%. The vote split 5-4, with a quartet of policymakers pushing for an immediate 0.25 percentage point trim to 3.75%. This close call—echoing the tension in August’s rate cut—signals that while the UK’s disinflationary pulse is steadying, policymakers are in no rush to declare victory. With CPI inflation judged to have peaked and labour market slack building, the stage is set for gradual easing ahead. But as the Autumn Budget looms on November 26, the BoE is playing it safe, waiting for more data to confirm the path back to its 2% target.

This hold isn’t just a procedural hiccup; it’s a masterclass in balancing act. For savers and fixed-income hunters, it’s a short-term win—rates stay elevated a bit longer. For borrowers and growth-chasers, it’s a reminder that the easing cycle, now three cuts deep since August 2024, won’t accelerate without clearer skies. Let’s break down the why, the who, and the what’s next, drawing from the fresh Monetary Policy Summary and Minutes.

The Economic Backdrop: Disinflation Takes Hold, But Persistence Lingers

The MPC’s deliberations painted a picture of an economy at an inflection point. Headline CPI inflation, which surged this year on energy base effects, food disruptions, and administered price hikes, has crested. Recent data shows services price inflation easing and pay growth moderating—key domestic anchors for underlying pressures. Yet, as the Minutes note (para 3-4), not all members are convinced the cooldown is durable. Household inflation expectations have ticked up, and some fear structural kinks in wage-price dynamics could breed persistence.

| Key Economic Indicators (as of October 2025) | Value | YoY Change | MPC Takeaway |

|---|---|---|---|

| CPI Inflation | 3.8% (Aug est.; Oct data pending) | Unchanged from July | Peaked; no second-round effects in central projection, but base effects drove 2025 uptick. |

| Services Inflation | Easing (exact: ~4.7% core Sep) | Down from peaks | Moderation supports disinflation; wage pass-through debated. |

| Unemployment Rate | 4.8% (Jun-Aug) | +0.2 pp QoQ | Labour slack building; vacancies falling, but structural shifts questioned. |

| Employment Rate (16-64) | 75.1% | -0.2 pp QoQ | Subdued growth; inactivity steady at 21.0%. |

| Average Wage Growth (ex-bonuses) | 4.7% (3m to Aug) | +1.2% real | Downward path, but plateau risks; forecast to hit 3.5% by end-2025. |

| GDP Growth (Q2 2025 est.) | Subdued (~0.75% annualized) | Below pre-pandemic norms | Weak consumption, elevated savings weighing; productivity dip -0.6% QoQ. |

These metrics underpin the MPC’s central projection: subdued demand and emerging slack are curbing inflation without tipping into recession. But two scenarios in the November Monetary Policy Report highlight the forks in the road. The “persistence” case—weighted heavily by inflation hawks—sees past shocks embedding into wage-setting, potentially requiring prolonged restriction. The “weaker demand” downside, eyed by doves, flags elevated household savings (a precautionary buffer against uncertainty) dragging consumption further. As para 13 sums it: risks are “more balanced,” but evidence is king.

The Vote: A House Divided, But United on Gradualism

The 5-4 split wasn’t ideological warfare but a nuanced clash over timing. The majority—Governor Andrew Bailey, Megan Greene, Clare Lombardelli, Catherine L. Mann, and Huw Pill—held firm, citing incomplete proof that disinflation won’t stall. Bailey, in his rationale (para 20), nodded to downside risks gaining traction but urged patience: one month’s soft CPI isn’t enough when labour costs linger high. Pill and Mann hammered “structural changes” in price-wage loops, drawing on micro-evidence like participation shifts (Box F).

The dissenters—Sarah Breeden, Swati Dhingra, Dave Ramsden, and Alan Taylor—saw the data as sufficient for action. Breeden highlighted slack’s dampening effect on pay (Box A on margins), while Dhingra and Taylor decried policy as “over-restrictive,” risking an undershoot amid weak demand (Box D). Taylor’s bearish tilt: slack is larger than models suggest, with peak unemployment still ahead.

| Voter | Stance | Key Rationale |

|---|---|---|

| Andrew Bailey | Hold | Balanced risks; wait for wage durability; downside more likely than upside. |

| Megan Greene | Hold | Upside risks dominant; expectations elevated; pause per simulations (Annex 1). |

| Clare Lombardelli | Hold | Forward pay indicators sticky; structural slack doubts; space for later cuts. |

| Catherine L. Mann | Hold | Persistence as central case; expectations risk second-round; firm stance needed. |

| Huw Pill | Hold | Slower easing pace; low-frequency trends show intrinsic persistence. |

| Sarah Breeden | Cut | Disinflation on track; slack building; insurance against demand weakness. |

| Swati Dhingra | Cut | Balanced risks, downside prominent; policy too tight; limited food pass-through. |

| Dave Ramsden | Cut | Central projection balanced, downside up; wage moderation via costs. |

| Alan Taylor | Cut | Weaker outlook; larger slack, lower terminal rate; undershoot risks. |

This fracture mirrors broader debates: how restrictive is 4% now (post prior cuts)? Neutral rate estimates vary wildly, but all agree nearing it muddies policy’s inflation signal (para 12).

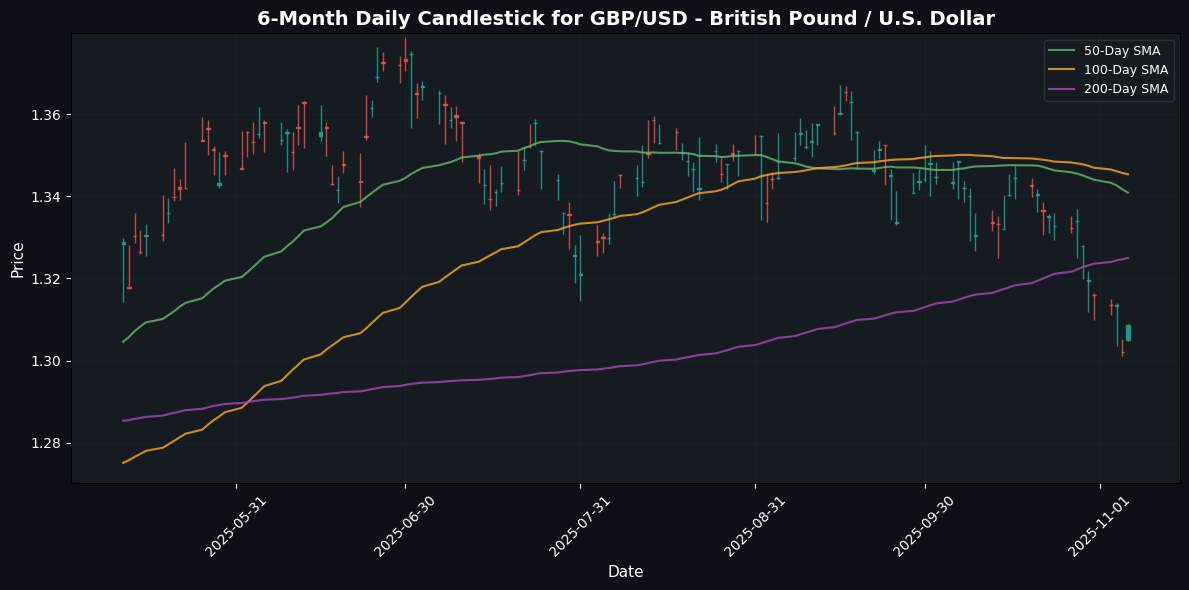

Market Ripples: Pound Perks Up, FTSE Dips on Cue

Markets had penciled in a hold (25-30% cut odds), but the squeaker vote trimmed bets on near-term easing—now fully priced for February 2026, with December a coin flip. The pound edged 0.3% firmer to $1.309, buoyed by hawkish tones, while the FTSE 100 slipped 30 points (0.3%) to 9747, dragged by construction woes—output cratered at the fastest pace in five years amid project delays. Gilt yields held at ~4.47% for 10-years, reflecting fiscal jitters ahead of the Budget.

For everyday punters: Savings rates hover at 4-5% (easy-access), mortgages ~4.2% fixed—status quo preserves the former, frustrates the latter. Construction’s slump (civil engineering and housing hit hardest) flags broader demand softness, per S&P Global PMI.

Looking Ahead: Budget Fog and the Easing Endgame

The Minutes are crystal on forward guidance (para 17): If disinflation holds, expect a “gradual downward path.” But the Budget—poised for tax hikes per analysts—could jolt demand, inflation, or both, tilting the scales. October CPI and jobs data (due soon) will be pivotal; doves want sequential soft prints, hawks need proof persistence is tamed.

In educator mode: This is textbook central banking—data-dependent, forward-looking, with lags in mind. The MPC’s restraint avoids premature easing (a la 2021’s inflation misfire) while nodding to growth costs. For investors, it’s a value-growth pivot: overweight cyclicals if cuts come quick, bunker in staples if persistence bites.

The next MPC powwow? December 17-18, minutes out Christmas week. Until then, eyes on Reeves’ fiscal bazooka. In a world of Trump tariffs and Eurozone divergence, the BoE’s tightrope walk feels all too British: measured, divided, and ever so slightly anxious.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.