European Markets Mixed: FTSE 100 Gains While CAC 40 Declines

European Trading Session Report | November 06, 2025 | Markets analysis during European hours (8:00 AM – 5:00 PM UTC)

📊 Market Commentary

### European Market Commentary: Mixed Session Amid Policy Anticipation

European equities traded in a subdued manner during today’s session, reflecting a cautious investor stance ahead of the Bank of England’s (BoE) policy decision and ongoing scrutiny of Eurozone fiscal dynamics. The pan-European Euro Stoxx 50 dipped 0.17%, weighed down by defensive rotations out of cyclical sectors, while the FTSE 100 bucked the trend with a 0.61% gain, buoyed by resilient UK banking exposure despite looming Budget measures. Germany’s DAX eked out a modest 0.13% advance, supported by industrial steadiness, but France’s CAC 40 fell 0.58%, pressured by consumer and luxury goods underperformance amid softer regional data.

Overnight, a broadly positive US close—where the S&P 500 rose 0.37%, Dow Jones 0.48%, and Nasdaq 100 0.72%—provided a mild tailwind, easing tariff-related concerns and lifting sentiment in tech and export-oriented names. Asian markets offered limited direction, with mixed signals from regional property woes, including elevated provisions in Hong Kong lending, tempering enthusiasm. This backdrop fostered selective positioning, with investors favoring UK financials on signals of a lighter tax burden for banks, while EV policy shifts toward per-mile charges in the UK stirred volatility in automotive supply chains.

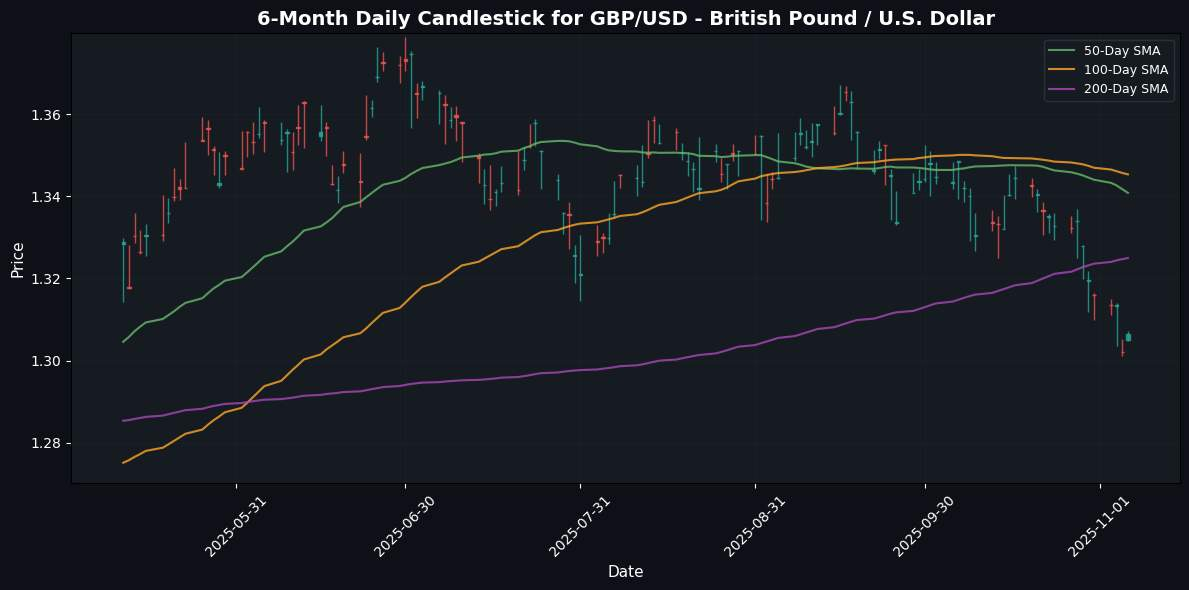

Currency dynamics highlighted a softer dollar, aiding European currencies. The EUR/USD pair climbed 0.13%, underpinned by ECB Executive Board member Isabel Schnabel’s remarks signaling a potential recalibration of the Eurosystem balance sheet, which bolstered rate-cut repricing and eased fiscal overhang fears in the Eurozone. GBP/USD followed suit with a 0.11% uptick, reflecting Budget optimism around growth-friendly tweaks, though EUR/GBP’s slight 0.01% widening suggests persistent sterling caution. The USD/CHF declined 0.06%, reinforcing safe-haven flows into the franc amid geopolitical noise from Middle Eastern project setbacks, including Saudi Arabia’s Neom ambitions, which rippled into broader emerging market scrutiny.

Sector trends pointed to outperformance in UK banks and Spanish lenders, with insider leadership transitions at major institutions signaling stability. Conversely, small-cap IPO probes in Saudi markets and diversity-focused corporate shifts highlighted valuation discipline. Overall market sentiment remains balanced but vigilant, with positioning skewed toward policy catalysts; Eurozone political developments and BoE outcomes will likely dictate near-term trajectories as investors navigate inflation persistence and global trade frictions.

(Word

🇪🇺 European Indices Performance

| Index | Price | Daily (%) |

|---|---|---|

| Euro Stoxx 50 | 5650.63 | -0.17 |

| DAX | 23979.75 | +0.13 |

| CAC 40 | 8021.00 | -0.58 |

| FTSE 100 | 9774.64 | +0.61 |

🇺🇸 US Markets (Previous Close)

| Index | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6796.29 | +0.37 |

| Dow Jones | 47311.00 | +0.48 |

| Nasdaq 100 | 25620.03 | +0.72 |

💱 Currency Pairs Performance

Performance: (Today Last – Today Open) / Today Open × 100

| Pair | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | +0.13 |

| GBP/USD | 1.31 | +0.11 |

| USD/JPY | 153.70 | -0.25 |

| EUR/GBP | 0.88 | +0.01 |

| USD/CHF | 0.81 | -0.06 |

| AUD/USD | 0.65 | -0.05 |

| USD/CAD | 1.41 | -0.01 |

📅 Today’s Economic Calendar

High and medium importance events. Times in US Eastern Time (ET).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-11-06 | 01:00 | 🇷🇺 | Medium | S&P Global Services PMI (Oct) | 51.7 | |

| 2025-11-06 | 02:00 | 🇸🇪 | Medium | CPI (YoY) (Oct) | 0.9% | 0.8% |

| 2025-11-06 | 02:00 | 🇸🇪 | Medium | CPI (MoM) (Oct) | 0.3% | 0.1% |

| 2025-11-06 | 02:00 | 🇪🇺 | Medium | German Industrial Production (MoM) (Sep) | 1.3% | 3.0% |

| 2025-11-06 | 03:10 | 🇪🇺 | Medium | ECB’s Schnabel Speaks | ||

| 2025-11-06 | 03:30 | 🇪🇺 | Medium | ECB’s De Guindos Speaks | ||

| 2025-11-06 | 04:00 | 🇳🇴 | Medium | Interest Rate Decision | 4.00% | |

| 2025-11-06 | 04:30 | 🇬🇧 | Medium | S&P Global Construction PMI (Oct) | 46.7 | |

| 2025-11-06 | 04:40 | 🇪🇺 | Medium | Spanish 15-Year Obligacion Auction | ||

| 2025-11-06 | 07:00 | 🇬🇧 | Medium | BoE MPC vote cut (Nov) | 3 | |

| 2025-11-06 | 07:00 | 🇬🇧 | Medium | BoE MPC vote hike (Nov) | 0 | |

| 2025-11-06 | 07:00 | 🇬🇧 | Medium | BoE MPC vote unchanged (Nov) | 6 | |

| 2025-11-06 | 07:00 | 🇬🇧 | High | BoE Interest Rate Decision (Nov) | 4.00% | |

| 2025-11-06 | 07:00 | 🇬🇧 | Medium | BoE MPC Meeting Minutes | ||

| 2025-11-06 | 07:30 | 🇬🇧 | Medium | BoE Gov Bailey Speaks | ||

| 2025-11-06 | 07:30 | 🇨🇦 | Medium | Trade Balance (Sep) | ||

| 2025-11-06 | 07:30 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-11-06 | 09:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-11-06 | 10:00 | 🇨🇦 | Medium | Ivey PMI (Oct) | 55.2 | |

| 2025-11-06 | 10:30 | 🇨🇦 | Medium | BoC Gov Macklem Speaks | ||

| 2025-11-06 | 11:00 | 🇺🇸 | Medium | Fed Vice Chair for Supervision Barr Speaks | ||

| 2025-11-06 | 11:00 | 🇺🇸 | Medium | FOMC Member Williams Speaks | ||

| 2025-11-06 | 11:15 | 🇪🇺 | Medium | German Buba Vice President Buch Speaks | ||

| 2025-11-06 | 12:00 | 🇺🇸 | Medium | Atlanta Fed GDPNow (Q4) | ||

| 2025-11-06 | 13:30 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-11-06 | 14:00 | 🇨🇦 | Medium | BoC Deputy Gov Kozicki Speaks | ||

| 2025-11-06 | 15:30 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-11-06 | 16:30 | 🇺🇸 | Medium | Fed’s Balance Sheet | ||

| 2025-11-06 | 18:30 | 🇯🇵 | Medium | Household Spending (YoY) (Sep) | 2.5% | |

| 2025-11-06 | 18:30 | 🇯🇵 | Medium | Household Spending (MoM) (Sep) |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.