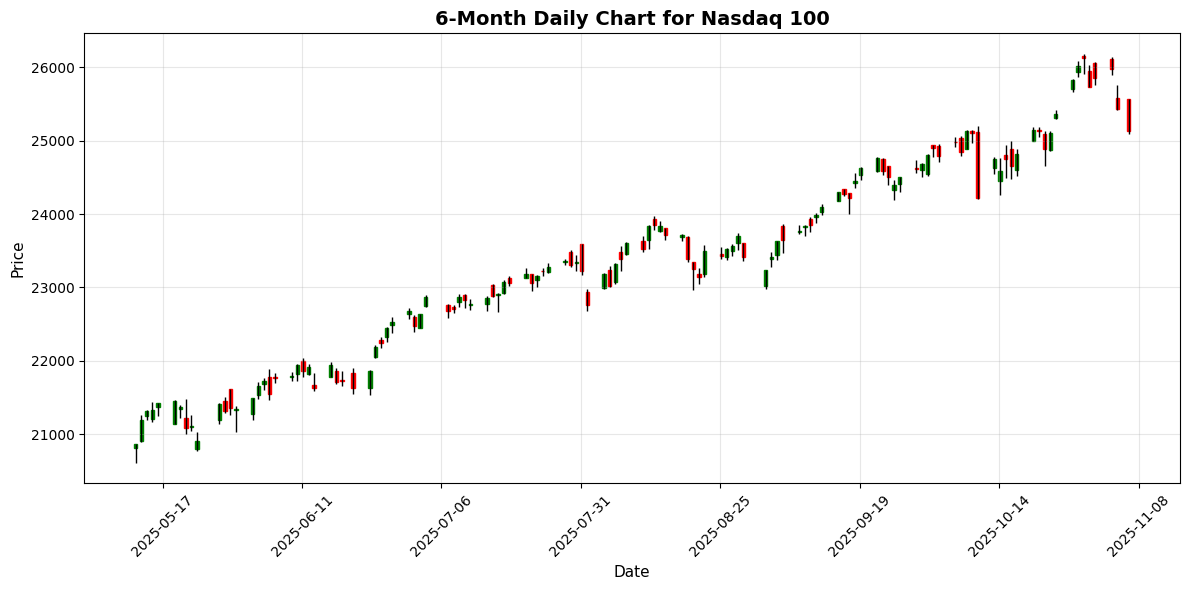

U.S. markets closed sharply lower Thursday, hammered by renewed pressure on AI stocks amid lofty valuations and uneven earnings. The Dow plunged nearly 400 points, while the Nasdaq’s 1.9% drop marked its worst week since April, driven by declines in Nvidia, AMD, and Palantir. October’s 153,000+ job cuts—the highest since 2003—stoked labor market fears, amplified by the ongoing government shutdown curbing data flows. Supreme Court skepticism on Trump tariffs added volatility risks.

US Majors

| Index | Close | Change | % Change |

|---|---|---|---|

| Dow Jones | 46,912.30 | -398.70 | -0.84% |

| S&P 500 | 6,720.32 | -76.00 | -1.12% |

| Nasdaq Composite | 23,053.99 | -447.00 | -1.90% |

Global Snapshot

Europe mixed: FTSE 100 flat post-BoE hold at 4% (5-4 vote signals gradual easing if disinflation holds); DAX/CAC down ~1% on soft retail sales. Nikkei rebounded modestly in Asia amid U.S. cues.

Commodities & Crypto

- Oil (WTI): ~$70/bbl, stable.

- Gold: Below $4,000/oz, off 5%+ from Oct record; retail buying plateaus.

- Bitcoin: Dipped below $100k on risk-off flows.

Bonds & FX

- 10Y Treasury: Yields ~4.3%, down 5bps on layoff data boosting Fed cut odds (90%+ for Dec).

- GBP/USD: Steady post-BoE; USD firmed vs. majors.