Crypto Market Technical Analysis: Decline on October 22, 2025

Published: October 22, 2025 at 11:53 PM UTC

📊 Market Overview

Today’s technical analysis covers the top 10 cryptocurrencies by market capitalization. This report includes advanced trendline analysis using key support and resistance levels across multiple timeframes (20-day, 50-day, and 200-day).

🟠 Bitcoin (BTC)

Current Price: $107,305 (-1.08%)

The original cryptocurrency and largest by market cap; often used as a benchmark for the entire market.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $139,992.87 (Long-Term, +30.46%)

R2: $131,923.95 (Medium-Term, +22.94%)

R1: $113,219.96 (Short-Term, +5.51%)

CURRENT PRICE: $107,304.84

Support Levels (Dynamic Support):

S1: $104,493.71 (Long-Term, -2.62%)

S2: $102,949.94 (Medium-Term, -4.06%)

S3: $101,372.75 (Short-Term, -5.53%)

📈 Technical Analysis

Bitcoin (BTC) is currently priced at $107304.84, showing a daily decline of 1.08%. The price is trading below key moving averages (MA21, MA50, MA100) indicating a bearish trend, with the MA200 at $108142.26 providing immediate support. The RSI at 39.01 suggests that BTC is nearing oversold conditions, which could lead to a potential reversal. Key support is found at $104493.71 (S1), while resistance is positioned at $113219.96 (R1). Short-term outlook remains cautious; a break below S1 could lead to further downside, while a rally above R1 may signal a shift in momentum.

⚪ Ethereum (ETH)

Current Price: $3,754 (-3.17%)

Leading smart-contract platform powering DeFi, NFTs, and token ecosystems.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $7,318.46 (Long-Term, +94.95%)

R2: $4,750.15 (Medium-Term, +26.54%)

R1: $4,066.90 (Short-Term, +8.34%)

CURRENT PRICE: $3,754.00

Support Levels (Dynamic Support):

S1: $3,672.85 (Long-Term, -2.16%)

S2: $3,503.83 (Short-Term, -6.66%)

S3: $3,228.14 (Medium-Term, -14.01%)

📈 Technical Analysis

Ethereum (ETH) is currently trading at $3754.00, showing a daily decline of 3.17%. The price is below the key moving averages (MA21 at $4160.64, MA50 at $4266.95, and MA100 at $4158.96), indicating bearish sentiment and potential downward pressure. The RSI is at 38.58, suggesting that ETH is approaching oversold territory, which may indicate a potential reversal if buying interest emerges. Immediate support is at $3672.85 (S1), while resistance is seen at $4066.90 (R1), creating a critical zone for price action. In the short term, a break below support could lead to further declines, while a rally above resistance may signal a corrective bounce.

🟡 Binance Coin (BNB)

Current Price: $1,063 (+0.53%)

Utility token of the Binance exchange; supports trading fee discounts and BNB Chain gas fees.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $1,620.69 (Medium-Term, +52.45%)

R2: $1,423.16 (Long-Term, +33.87%)

R1: $1,316.32 (Short-Term, +23.82%)

CURRENT PRICE: $1,063.07

Support Levels (Dynamic Support):

S1: $1,028.58 (Short-Term, -3.24%)

S2: $1,010.94 (Long-Term, -4.90%)

S3: $1,006.91 (Medium-Term, -5.28%)

📈 Technical Analysis

Binance Coin (BNB) is currently trading at $1063.07, slightly above its 50-day moving average of $1041.37, indicating potential bullish momentum. The RSI at 45.55 suggests that BNB is nearing neutral territory, which may lead to increased buying interest if it crosses above 50. Key support is located at $1028.58 (S1), while immediate resistance is at $1316.32 (R1), representing a significant upside potential. Short-term outlook remains cautiously optimistic, but a break below S1 could signal a deeper correction towards $1010.94 (S2).

🔵 XRP (XRP)

Current Price: $2.34 (-3.45%)

Used for cross-border payments; issued by Ripple Labs and widely traded despite past legal scrutiny.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $4.52 (Long-Term, +93.15%)

R2: $2.86 (Medium-Term, +22.33%)

R1: $2.50 (Short-Term, +6.82%)

CURRENT PRICE: $2.34

Support Levels (Dynamic Support):

S1: $1.92 (Short-Term, -18.15%)

S2: $1.52 (Long-Term, -35.00%)

S3: $1.25 (Medium-Term, -46.43%)

📈 Technical Analysis

XRP is currently trading at $2.34, showing a daily decline of 3.45%. The price is below key moving averages, with the MA21 at $2.62 and the MA50 at $2.80, indicating a bearish trend. The RSI is at 37.02, suggesting that XRP is approaching oversold conditions, which could lead to a potential reversal if buying interest increases. Immediate support is at $1.92 (S1), while resistance is found at $2.50 (R1). Short-term outlook remains cautious; a break below $1.92 could lead to further declines, while a move above $2.50 would signal a potential recovery.

🟣 Solana (SOL)

Current Price: $178.86 (-3.66%)

High-performance blockchain optimized for speed and scalability; popular in DeFi and NFT markets.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $275.36 (Long-Term, +53.95%)

R2: $224.04 (Medium-Term, +25.25%)

R1: $194.92 (Short-Term, +8.98%)

CURRENT PRICE: $178.86

Support Levels (Dynamic Support):

S1: $177.43 (Long-Term, -0.80%)

S2: $165.85 (Medium-Term, -7.28%)

S3: $165.05 (Short-Term, -7.72%)

📈 Technical Analysis

Solana (SOL) is currently trading at $178.86, showing a daily decline of 3.66%. The price is below the 21-day and 50-day moving averages, indicating a bearish trend, with the RSI at 38.23 suggesting oversold conditions. Key support is at $177.43 (S1), which is critical for maintaining the current trend; a breakdown here could lead to further declines towards $165.85 (S2). Conversely, resistance is at $194.92 (R1), and a move above this level could signal a potential reversal. Short-term outlook remains cautious, with a focus on the support level to gauge further price action.

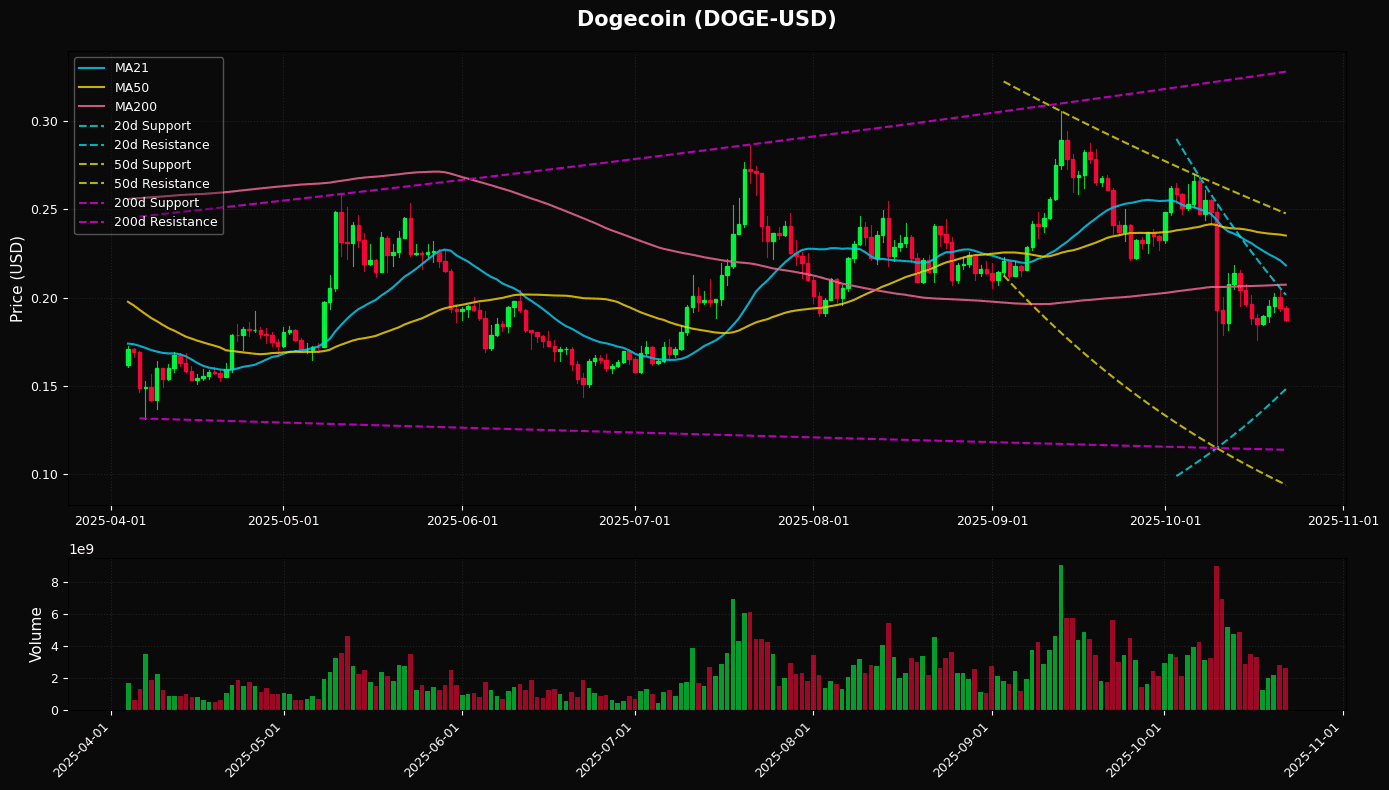

🟤 Dogecoin (DOGE)

Current Price: $0.1876 (-3.49%)

The meme-coin that became mainstream; still ranks high by volume due to its active retail community.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $0.33 (Long-Term, +74.89%)

R2: $0.25 (Medium-Term, +32.07%)

R1: $0.20 (Short-Term, +7.43%)

CURRENT PRICE: $0.19

Support Levels (Dynamic Support):

S1: $0.15 (Short-Term, -20.99%)

S2: $0.11 (Long-Term, -39.35%)

S3: $0.09 (Medium-Term, -49.90%)

📈 Technical Analysis

Dogecoin (DOGE) is currently trading at $0.19, below its key moving averages (MA21 at $0.22, MA50 at $0.24, and MA100 at $0.23), indicating a bearish trend. The RSI is at 38.42, suggesting that DOGE is approaching oversold conditions, which may provide a potential reversal point. Immediate support is at $0.15 (S1), while resistance is found at $0.20 (R1), making these levels crucial for short-term trading decisions. A break below $0.15 could lead to further declines towards $0.11 (S2), whereas a move above $0.20 could signal a short-term bullish reversal. Overall, cautious trading is advised as the price remains under downward pressure.

🔵 Cardano (ADA)

Current Price: $0.6167 (-4.08%)

Research-driven blockchain project focused on scalability, sustainability, and academic rigor.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $1.15 (Long-Term, +86.21%)

R2: $0.83 (Medium-Term, +33.97%)

R1: $0.67 (Short-Term, +9.07%)

CURRENT PRICE: $0.62

Support Levels (Dynamic Support):

S1: $0.48 (Short-Term, -21.97%)

S2: $0.32 (Long-Term, -47.51%)

S3: $0.25 (Medium-Term, -59.76%)

📈 Technical Analysis

Cardano (ADA) is currently trading at $0.62, below its short-term moving averages (MA21 at $0.73 and MA50 at $0.80), indicating a bearish trend. The RSI at 34.79 suggests that the asset is oversold, which may lead to a potential rebound if buying interest increases. Immediate resistance is at $0.67 (R1), while the nearest support level is at $0.48 (S1), representing a significant downside risk. A break below $0.48 could lead to further declines towards $0.32 (S2), while a move above $0.67 would indicate a shift towards a more bullish sentiment in the short term. Traders should monitor these levels closely for actionable insights.

🔴 TRON (TRX)

Current Price: $0.3192 (-0.81%)

Decentralized content-sharing and DeFi ecosystem with strong presence in Asia.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $0.45 (Long-Term, +41.76%)

R2: $0.34 (Medium-Term, +7.23%)

R1: $0.32 (Short-Term, +1.69%)

CURRENT PRICE: $0.32

Support Levels (Dynamic Support):

S1: $0.31 (Long-Term, -3.71%)

S2: $0.31 (Medium-Term, -4.38%)

S3: $0.30 (Short-Term, -6.77%)

📈 Technical Analysis

TRON (TRX) is currently trading at $0.32, slightly below its short-term moving averages (MA21, MA50, MA100) at $0.33, indicating a bearish sentiment. The RSI at 43.27 suggests that TRX is nearing oversold conditions, while the MACD at -0.0054 confirms a bearish momentum. Immediate support is found at $0.31 (200-day MA), with a potential drop to $0.30 if bearish pressure continues. Resistance is at $0.32 (20-day MA), which needs to be broken for a bullish reversal; however, a failure to hold above support could lead to further downside in the short term.

🔴 Avalanche (AVAX)

Current Price: $18.76 (-4.06%)

Fast-growing Layer-1 platform supporting customizable blockchains and DeFi protocols.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $38.48 (Long-Term, +105.07%)

R2: $27.04 (Medium-Term, +44.10%)

R1: $20.24 (Short-Term, +7.90%)

CURRENT PRICE: $18.76

Support Levels (Dynamic Support):

S1: $14.53 (Short-Term, -22.57%)

S2: $10.42 (Long-Term, -44.47%)

S3: $8.14 (Medium-Term, -56.62%)

📈 Technical Analysis

Avalanche (AVAX) is currently trading at $18.76, showing a daily decline of 4.06%. The price is significantly below its moving averages, with the MA21 at $24.39 and the MA50 at $27.36, indicating a bearish trend. The RSI is at 29.35, suggesting that AVAX is oversold, which may lead to a potential short-term rebound. Immediate support is at $14.53 (S1), while resistance is found at $20.24 (R1); a break above this level could signal a shift in momentum. Traders should watch for a potential bounce from support or a continuation of the bearish trend if prices dip below $14.53.

🔴 Polkadot (DOT)

Current Price: $2.87 (-4.55%)

Interoperability-focused network connecting multiple blockchains; key project in the Web 3.0 ecosystem.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $4.76 (Long-Term, +65.77%)

R2: $4.09 (Medium-Term, +42.39%)

R1: $3.10 (Short-Term, +8.16%)

CURRENT PRICE: $2.87

Support Levels (Dynamic Support):

S1: $2.13 (Short-Term, -25.80%)

S2: $1.34 (Long-Term, -53.46%)

S3: $1.02 (Medium-Term, -64.34%)

📈 Technical Analysis

Polkadot (DOT) is currently trading at $2.87, showing a daily decline of 4.55%. The price is significantly below the moving averages, with the MA21 at $3.50, indicating bearish momentum. The RSI at 33.98 suggests that DOT is approaching oversold conditions, but the MACD at -0.2937 confirms a continued bearish trend. Key support is located at $2.13 (S1), while immediate resistance is at $3.10 (R1). A potential short-term outlook indicates a struggle to reclaim resistance levels, with a focus on the support at $2.13 to avoid further declines.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. Cryptocurrency investments are highly volatile and risky. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.