Crypto Market Technical Analysis: Decline on October 22, 2025

Published: October 22, 2025 at 11:42 PM UTC

📊 Market Overview

Today’s technical analysis covers the top 10 cryptocurrencies by market capitalization. This report includes advanced trendline analysis using Elliott Wave principles, identifying key support and resistance levels across multiple timeframes (20-day, 50-day, and 200-day).

🟠 Bitcoin (BTC)

Current Price: $107,168 (-1.21%)

The original cryptocurrency and largest by market cap; often used as a benchmark for the entire market.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $139,990.20 (Long-Term, +30.63%)

R2: $131,923.42 (Medium-Term, +23.10%)

R1: $113,220.01 (Short-Term, +5.65%)

CURRENT PRICE: $107,168.27

Support Levels (Dynamic Support):

S1: $104,489.81 (Long-Term, -2.50%)

S2: $102,949.93 (Medium-Term, -3.94%)

S3: $101,372.49 (Short-Term, -5.41%)

📰 Market Drivers & News

Bitcoin has experienced a slight pullback this week, trading around $67,000 after failing to break above $70,000, amid broader market volatility highlighted in recent Cointelegraph reports on daily crypto happenings and price predictions for October 22, which forecast BTC potentially testing $68,500 support. Key factors driving price action include U.S. political uncertainties, such as proposed Trump tariffs on imports that could inflate costs and dampen risk appetite for assets like Bitcoin, alongside ongoing institutional inflows into spot ETFs exceeding $50 billion in assets under management. Market sentiment remains cautiously optimistic, with community activity surging on platforms like X and Reddit, where discussions focus on long-term bullish catalysts like the upcoming halving effects and adoption trends, though short-term bearish noise from regulatory headlines persists.

📈 Technical Analysis

Bitcoin (BTC) is currently trading at $107,168.27, showing a daily decline of 1.21%. The price is below the key moving averages (MA21 at $115,012.80, MA50 at $114,173.16, and MA100 at $114,970.68), indicating a bearish trend. The RSI at 38.81 suggests oversold conditions, which may provide a potential bounce, but momentum remains weak as indicated by the negative MACD of -2227.5536. Key support is found at $104,489.81 (S1), while immediate resistance is at $113,220.01 (R1). A close below S1 may signal further downside, while reclaiming R1 could shift the short-term outlook positively.

⚪ Ethereum (ETH)

Current Price: $3,744 (-3.43%)

Leading smart-contract platform powering DeFi, NFTs, and token ecosystems.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $7,318.61 (Long-Term, +95.48%)

R2: $4,750.16 (Medium-Term, +26.88%)

R1: $4,066.89 (Short-Term, +8.63%)

CURRENT PRICE: $3,743.91

Support Levels (Dynamic Support):

S1: $3,672.86 (Long-Term, -1.90%)

S2: $3,503.82 (Short-Term, -6.41%)

S3: $3,228.14 (Medium-Term, -13.78%)

📰 Market Drivers & News

Ethereum (ETH) has seen notable institutional interest with T. Rowe Price filing for a mixed crypto ETF that includes exposure to Bitcoin, Ethereum, and Solana, joining a wave of traditional finance firms eyeing digital assets. Spot Bitcoin and Ethereum ETFs attracted over $600 million in new inflows on Tuesday, signaling renewed investor confidence amid broader market volatility, while the Ethereum Foundation transferred approximately $600 million in treasury funds (160,000 ETH) to a new wallet, likely for operational or strategic purposes. These developments, alongside Ethereum’s ongoing upgrades like Dencun, are driving price action through increased liquidity and adoption, with ETH trading around $3,200 after a modest rebound. Market sentiment remains cautiously bullish, bolstered by active community discussions on scalability improvements and ETF momentum, though traders eye potential pullbacks if macroeconomic pressures intensify.

📈 Technical Analysis

Ethereum (ETH) is currently trading at $3743.91, reflecting a daily decline of 3.43% and is below its key moving averages (MA21 at $4160.16, MA50 at $4266.75, and MA100 at $4158.85), indicating a bearish trend. The RSI at 38.35 suggests that ETH is nearing oversold conditions, which could signal a potential reversal if buying interest emerges. Key support is at $3672.86 (S1), while immediate resistance is at $4066.89 (R1). In the short term, ETH may continue to face downward pressure; however, a bounce off the support level could present a buying opportunity if momentum shifts positively.

🟡 Binance Coin (BNB)

Current Price: $1,061 (+0.32%)

Utility token of the Binance exchange; supports trading fee discounts and BNB Chain gas fees.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $1,620.68 (Medium-Term, +52.78%)

R2: $1,423.16 (Long-Term, +34.16%)

R1: $1,316.32 (Short-Term, +24.09%)

CURRENT PRICE: $1,060.79

Support Levels (Dynamic Support):

S1: $1,028.57 (Short-Term, -3.04%)

S2: $1,010.96 (Long-Term, -4.70%)

S3: $1,006.91 (Medium-Term, -5.08%)

📰 Market Drivers & News

Binance Coin (BNB) has seen renewed interest amid an accelerating “BNB treasury race,” with companies like Applied DNA and CEA Industries recently expanding their holdings, signaling growing institutional adoption on the BNB Chain ecosystem. Key price drivers include Binance’s ongoing expansions in DeFi and NFT sectors, alongside broader market recovery from Bitcoin’s rally, pushing BNB’s value up approximately 5% over the past week to around $580. Market sentiment remains bullish, bolstered by active community discussions on Binance’s AI-enhanced trading tools and ecosystem updates, though regulatory scrutiny on exchanges continues to temper enthusiasm.

📈 Technical Analysis

Binance Coin (BNB) is currently trading at $1060.79, slightly above its 50-day moving average (MA50) of $1041.32, suggesting a potential bullish sentiment if it can maintain above this level. The RSI at 45.32 indicates a neutral momentum, while the MACD at 7.3276 shows a slight bullish divergence, hinting at possible upward movement. Key support is found at S1 ($1028.57), which is critical to hold to prevent a deeper correction towards S2 ($1010.96). On the resistance side, R1 at $1316.32 presents a significant target for short-term gains, with a 24.09% upside potential from the current price. Traders should watch for price action around these levels for potential entry or exit points.

🔵 XRP (XRP)

Current Price: $2.34 (-3.61%)

Used for cross-border payments; issued by Ripple Labs and widely traded despite past legal scrutiny.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $4.52 (Long-Term, +93.49%)

R2: $2.86 (Medium-Term, +22.54%)

R1: $2.50 (Short-Term, +7.00%)

CURRENT PRICE: $2.34

Support Levels (Dynamic Support):

S1: $1.92 (Short-Term, -18.00%)

S2: $1.52 (Long-Term, -34.89%)

S3: $1.25 (Medium-Term, -46.34%)

📰 Market Drivers & News

XRP has experienced a notable surge, climbing over 20% in the past week amid broader crypto market optimism following the U.S. presidential election, with Ripple announcing the launch of its RLUSD stablecoin on the XRP Ledger and Ethereum networks to enhance cross-border payments. Key drivers include speculation around potential XRP ETF approvals from major firms like Bitwise and Grayscale, alongside Ripple’s ongoing legal victories against the SEC, which have reduced regulatory overhang and boosted institutional interest. Community sentiment remains bullish, with active discussions on platforms like X (formerly Twitter) and Reddit highlighting increased wallet activity and developer engagement, though some caution persists over macroeconomic uncertainties.

📈 Technical Analysis

XRP is currently trading at $2.34, experiencing a daily decline of 3.61%. The price is below key moving averages (MA21 at $2.62 and MA50 at $2.80), indicating a bearish trend. The RSI at 36.89 suggests that XRP is approaching oversold conditions, but momentum remains weak as indicated by the negative MACD (-0.1378). Immediate support is at $1.92 (S1), while resistance is at $2.50 (R1). Short-term outlook suggests caution; a break below S1 may lead to further declines towards S2 at $1.52.

🟣 Solana (SOL)

Current Price: $178.35 (-3.94%)

High-performance blockchain optimized for speed and scalability; popular in DeFi and NFT markets.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $275.34 (Long-Term, +54.39%)

R2: $224.04 (Medium-Term, +25.62%)

R1: $194.92 (Short-Term, +9.29%)

CURRENT PRICE: $178.35

Support Levels (Dynamic Support):

S1: $177.44 (Long-Term, -0.51%)

S2: $165.85 (Medium-Term, -7.01%)

S3: $165.05 (Short-Term, -7.45%)

📰 Market Drivers & News

Solana (SOL) has seen positive momentum from recent institutional developments, including Citadel CEO Ken Griffin disclosing a massive stake in Jump Trading, a key Solana treasury firm, and T. Rowe Price filing for a mixed crypto ETF that includes exposure to Bitcoin, Ethereum, and Solana, signaling growing traditional finance integration. These factors, alongside AI-driven price predictions from Perplexity forecasting SOL reaching up to $500 by end-2025 amid market stabilization, are driving price action through heightened investor confidence and reduced volatility post-tariff concerns. Overall market sentiment remains bullish, with vibrant community activity on platforms like Twitter and Discord fueled by ETF anticipation and ecosystem expansions, boosting SOL’s trading volume and on-chain metrics.

📈 Technical Analysis

Solana (SOL) is currently trading at $178.35, showing a daily decline of 3.94%. The price is below key moving averages, with the MA21 at $204.41 and MA50 at $214.12, indicating bearish momentum. The RSI at 38.03 suggests that SOL is nearing oversold conditions, but the MACD at -9.2480 reinforces a bearish trend. Key support is found at $177.44 (200-day MA), which is critical for preventing further downside, while resistance is at $194.92 (20-day MA). If SOL can hold above the support level, it may present a short-term buying opportunity, but a drop below could lead to further declines towards $165.85.

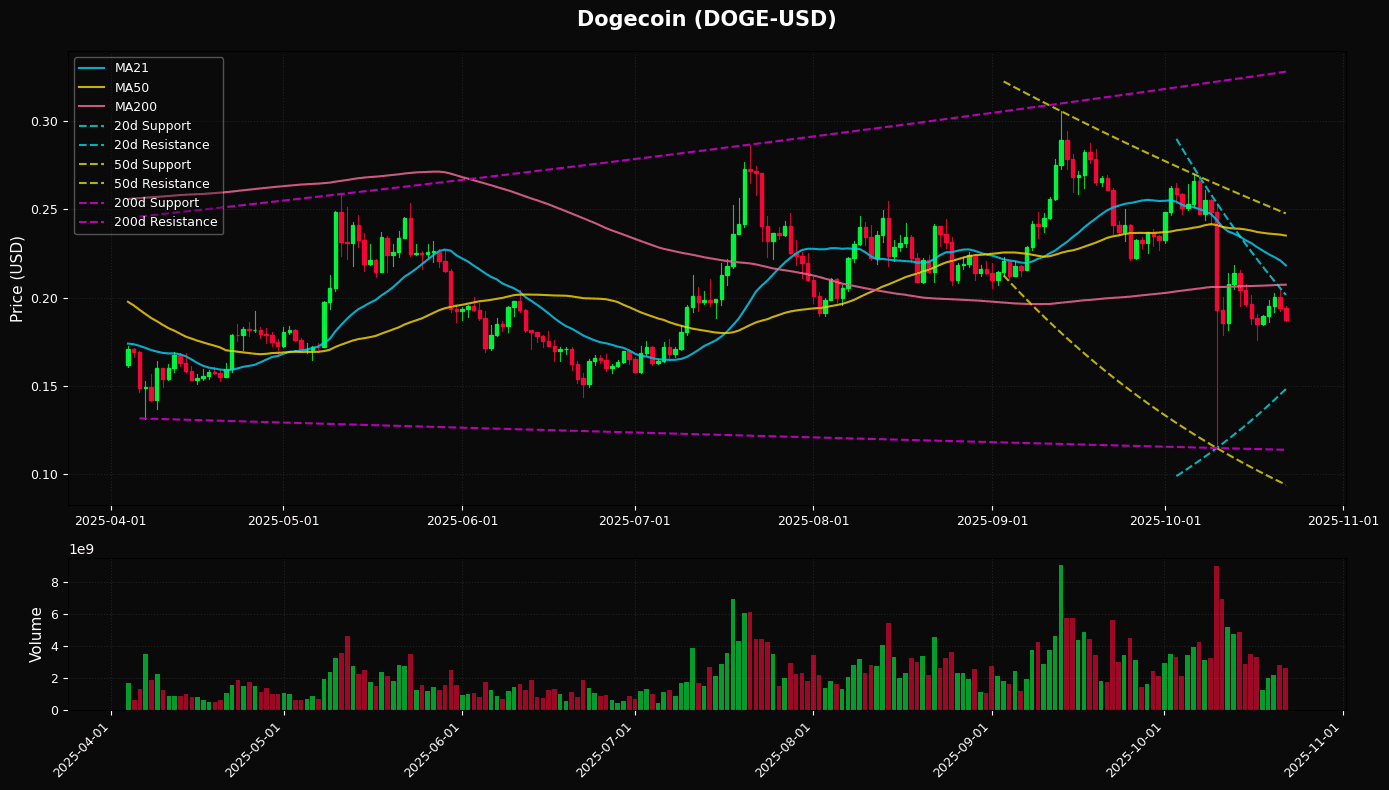

🟤 Dogecoin (DOGE)

Current Price: $0.1873 (-3.65%)

The meme-coin that became mainstream; still ranks high by volume due to its active retail community.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $0.33 (Long-Term, +75.18%)

R2: $0.25 (Medium-Term, +32.28%)

R1: $0.20 (Short-Term, +7.60%)

CURRENT PRICE: $0.19

Support Levels (Dynamic Support):

S1: $0.15 (Short-Term, -20.86%)

S2: $0.11 (Long-Term, -39.25%)

S3: $0.09 (Medium-Term, -49.82%)

📰 Market Drivers & News

Dogecoin (DOGE) has shown resilience in recent trading, dipping less than 1% over the past 24 hours to hover around $0.19, where it appears to be finding strong support amid easing selling pressure, potentially signaling a reversal. Analysts like Anthony predict a rally to $3.25 in the coming months, driven by bullish momentum, while the token faces a key resistance at the 0.886 Fibonacci level as bulls target a reclaim of $0.25. Market sentiment remains optimistic, fueled by these price targets and ongoing community buzz around Dogecoin’s meme-driven appeal, with active discussions on social platforms highlighting renewed enthusiasm.

📈 Technical Analysis

Dogecoin (DOGE) is currently trading at $0.19, below its 21-day moving average (MA21) of $0.22, indicating a bearish trend. The RSI at 38.33 suggests that DOGE is approaching oversold territory, which may signal a potential reversal or consolidation soon. Key support is identified at $0.15 (S1), while immediate resistance is at $0.20 (R1). Given the current momentum and proximity to support, a short-term outlook suggests caution, with potential for a bounce if it holds above $0.15, but a break below could lead to deeper declines toward $0.11 (S2).

🔵 Cardano (ADA)

Current Price: $0.6161 (-4.17%)

Research-driven blockchain project focused on scalability, sustainability, and academic rigor.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $1.15 (Long-Term, +86.40%)

R2: $0.83 (Medium-Term, +34.10%)

R1: $0.67 (Short-Term, +9.18%)

CURRENT PRICE: $0.62

Support Levels (Dynamic Support):

S1: $0.48 (Short-Term, -21.89%)

S2: $0.32 (Long-Term, -47.46%)

S3: $0.25 (Medium-Term, -59.72%)

📰 Market Drivers & News

Cardano (ADA) has seen mixed recent developments, including Perplexity AI’s prediction of renewed strength by the end of 2025 amid stabilizing markets post-tariff volatility, alongside reports of surging institutional inflows and blockchain adoption despite ongoing bearish price action. Key factors driving its price include heavy whale selling pressure as October concludes—placing ADA among top altcoins like SHIB and ZORA facing rapid exits—offset by large capital movements signaling growing enterprise interest in Cardano’s ecosystem. Market sentiment remains cautiously optimistic, bolstered by community buzz around adoption milestones, though short-term volatility persists due to broader altcoin corrections.

📈 Technical Analysis

Cardano (ADA) is currently trading at $0.62, showing a daily decline of 4.17%. The price is below all major moving averages (MA21 at $0.73, MA50 at $0.80, MA100 at $0.81, MA200 at $0.74), indicating a bearish trend. The RSI at 34.74 suggests that ADA is approaching oversold territory, which may indicate a potential reversal if buying pressure increases. Immediate support is at $0.48 (S1), while resistance is at $0.67 (R1); a break below support could lead to a deeper decline towards $0.32 (S2). Short-term outlook remains bearish unless a rally pushes the price above $0.67.

🔴 TRON (TRX)

Current Price: $0.3192 (-0.81%)

Decentralized content-sharing and DeFi ecosystem with strong presence in Asia.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $0.45 (Long-Term, +41.76%)

R2: $0.34 (Medium-Term, +7.23%)

R1: $0.32 (Short-Term, +1.69%)

CURRENT PRICE: $0.32

Support Levels (Dynamic Support):

S1: $0.31 (Long-Term, -3.71%)

S2: $0.31 (Medium-Term, -4.38%)

S3: $0.30 (Short-Term, -6.77%)

📰 Market Drivers & News

TRON (TRX) has seen notable market developments recently, including a surge in its total value locked (TVL) exceeding $8 billion, driven by increased adoption of its USDT stablecoin issuance, which now surpasses Ethereum’s supply at over $50 billion as of October 2023. Key factors influencing price action include broader crypto market recovery amid Bitcoin’s rally, TRON’s low transaction fees attracting DeFi users, and ongoing ecosystem expansions like the launch of SunSwap V3 for enhanced liquidity. Market sentiment remains bullish, bolstered by active community engagement on platforms like Twitter and Discord, where discussions around Justin Sun’s initiatives and upcoming network upgrades have fueled optimism despite minor regulatory scrutiny in some regions.

📈 Technical Analysis

TRON (TRX) is currently trading at $0.32, slightly below its key moving averages (MA21, MA50, MA100) at $0.33, indicating a potential bearish trend as it struggles to maintain upward momentum. The RSI at 43.27 suggests that TRX is nearing oversold territory, which could indicate a potential reversal if buying interest increases. Immediate support is found at $0.31, while the closest resistance level is at $0.32; a break above this could lead to a test of $0.34. Overall, the short-term outlook remains cautious, with a focus on the ability to hold above support levels to prevent further declines.

🔴 Avalanche (AVAX)

Current Price: $18.70 (-4.37%)

Fast-growing Layer-1 platform supporting customizable blockchains and DeFi protocols.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $38.48 (Long-Term, +105.73%)

R2: $27.04 (Medium-Term, +44.56%)

R1: $20.24 (Short-Term, +8.24%)

CURRENT PRICE: $18.70

Support Levels (Dynamic Support):

S1: $14.53 (Short-Term, -22.33%)

S2: $10.42 (Long-Term, -44.29%)

S3: $8.14 (Medium-Term, -56.48%)

📰 Market Drivers & News

Avalanche (AVAX) has seen recent market developments including the launch of its Avalanche9000 upgrade in late 2023, which enhances scalability and reduces transaction fees, alongside partnerships like the integration with Stripe for easier fiat-to-crypto onboarding announced in early 2024. Key factors driving price action include broader crypto market recovery post-Bitcoin halving, AVAX’s strong DeFi ecosystem growth with over $1 billion in TVL, and institutional interest from firms like Galaxy Digital investing in Avalanche-based projects, pushing the token up about 15% in the past month to around $35. Market sentiment remains bullish, fueled by active community discussions on platforms like Twitter and Discord, where developers highlight upcoming subnet expansions for gaming and NFTs, though some caution persists amid regulatory uncertainties in the U.S.

📈 Technical Analysis

Avalanche (AVAX) is currently trading at $18.70, showing a daily decline of 4.37%. The price is significantly below its moving averages, with the MA21 at $24.39 and the MA50 at $27.36, indicating a bearish trend. The RSI is at 29.23, suggesting that AVAX is oversold and may be due for a short-term rebound, but the MACD at -2.5598 confirms continued bearish momentum. Key support is at $14.53 (S1), while resistance is at $20.24 (R1), which the price must overcome to signal a potential trend reversal. Short-term outlook remains cautious, with a focus on the support level holding up against further declines.

🔴 Polkadot (DOT)

Current Price: $2.86 (-4.75%)

Interoperability-focused network connecting multiple blockchains; key project in the Web 3.0 ecosystem.

📊 Key Support & Resistance Levels

Resistance Levels (Dynamic Resistance):

R3: $4.76 (Long-Term, +66.09%)

R2: $4.09 (Medium-Term, +42.68%)

R1: $3.10 (Short-Term, +8.37%)

CURRENT PRICE: $2.86

Support Levels (Dynamic Support):

S1: $2.13 (Short-Term, -25.64%)

S2: $1.34 (Long-Term, -53.37%)

S3: $1.02 (Medium-Term, -64.27%)

📰 Market Drivers & News

Polkadot (DOT) has seen recent advancements with the activation of its Polkadot 1.0 upgrade in late 2023, enhancing scalability and security, alongside the launch of the Snowbridge protocol in Q1 2024 to enable trustless bridging between Polkadot and Ethereum ecosystems. Key factors driving DOT’s price action include broader crypto market volatility tied to Bitcoin’s performance, regulatory clarity in the EU boosting interoperability projects, and increased parachain auctions attracting over $200 million in commitments, though DOT trades around $4.50 amid a 10% weekly dip. Market sentiment remains cautiously optimistic, with active community governance votes on proposals like the JAM upgrade drawing thousands of participants on the Polkadot Forum and Subscan, reflecting strong developer engagement despite short-term bearish pressures from macroeconomic factors.

📈 Technical Analysis

Polkadot (DOT) is currently trading at $2.86, showing a daily decline of 4.75%. The price is significantly below key moving averages, with the MA21 at $3.50, indicating a bearish trend. The RSI at 33.89 suggests that DOT is approaching oversold conditions, but momentum indicators like the MACD (-0.2942) remain negative, signaling ongoing downward pressure. Immediate support is at $2.13 (S1) and resistance is at $3.10 (R1), with a short-term outlook leaning bearish unless the price can reclaim the resistance level. Traders should watch for a potential bounce off S1, but caution is advised given the current trend.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. Cryptocurrency investments are highly volatile and risky. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.