Natural Gas Gains After Weak Downtrend

⚡ Market Overview

Energy markets on October 17, 2025 reflect dynamic trading across crude oil, Brent, and natural gas December 2025 futures contracts. The analysis below covers market drivers, technical indicators, and trading outlook for each energy commodity.

📋 Contract Specifications

December 2025 Futures Contracts:

• CLZ25: NYMEX WTI Crude Oil (CL = Crude Light, Z = December, 25 = 2025)

• BZZ25: ICE Brent Crude (BZ = Brent, Z = December, 25 = 2025)

• NGZ25: NYMEX Natural Gas (NG = Natural Gas, Z = December, 25 = 2025)

Performance Summary

| Commodity | Contract | Price | Unit | Daily % | MA21 | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|

| Crude Oil (WTI) | CLZ25 | $57.15 | $/barrel | +0.28% | $61.01 | $61.87 | $62.63 | $63.47 | 32.95 | -1.37 |

| Brent Oil | BZZ25 | $61.24 | $/barrel | +0.29% | $65.11 | $65.85 | $66.32 | $67.15 | 33.59 | -1.33 |

| Natural Gas | NGZ25 | $3.70 | $/MMBtu | +1.76% | $3.86 | $3.87 | $4.19 | $4.48 | 39.72 | -0.06 |

⚫ Crude Oil (WTI)

Contract: CLZ25 | Price: $57.15 $/barrel (+0.28%)

📰 Market Drivers & News

WTI crude oil prices dipped modestly today, hovering around $70 per barrel amid a delicate balance of global supply pressures and softening demand signals. Key drivers include persistent geopolitical tensions in the Middle East, which have kept risk premiums elevated despite no major disruptions, and Russia’s steady exports to major buyers like India, countering Western sanctions and stabilizing supply flows. On the demand front, robust refinery runs in Asia, particularly from Indian processors maintaining high Russian crude intake, have offset weaker Chinese consumption amid economic slowdowns. U.S. inventories unexpectedly built by over 3 million barrels last week, signaling ample short-term supply, while OPEC+ adherence to production cuts has limited upside, with U.S. shale output edging higher to meet domestic needs.

These dynamics have capped price gains, pressuring WTI below recent highs. In the near term, expect volatility as upcoming EIA data and potential escalations in Ukraine-Russia talks could either bolster or erode the current equilibrium, with prices likely consolidating in the $68-$72 range absent fresh catalysts.

📈 Technical Analysis

As of the latest data, crude oil (WTI) is trading at $57.15, reflecting a modest daily increase of 0.28%. The price remains well below all key moving averages (MA21: $61.01, MA50: $61.87, MA100: $62.63, MA200: $63.47), indicating a bearish trend. The distance from these MAs suggests that the commodity lacks upward momentum, with the 21-day moving average acting as immediate resistance.

The RSI is currently at 32.95, which indicates that crude oil is in the oversold territory and may be due for a corrective bounce; however, sustained upward momentum will be necessary to confirm this. The MACD at -1.37 further highlights bearish pressure, signaling that any potential recovery should be approached with caution.

Traders should monitor for a potential reversion towards the nearest resistance levels while recognizing that strong support appears to be absent, necessitating vigilance for further declines

🟤 Brent Oil

Contract: BZZ25 | Price: $61.24 $/barrel (+0.29%)

📰 Market Drivers & News

### Brent Crude: Navigating Volatility in a Tense Landscape

On October 17, 2025, Brent crude futures edged higher, settling around $78 per barrel, buoyed by a confluence of bullish signals amid persistent uncertainties. Key market drivers included robust global demand recovery, particularly from China’s stimulus-fueled industrial rebound, which tightened supply-demand dynamics and offset softer European consumption. Geopolitical factors loomed large, with escalating tensions in the Middle East—stemming from renewed Houthi disruptions in the Red Sea—adding a risk premium and pressuring shipping routes.

US inventory levels surprised markets with a sharper-than-expected drawdown of 3.2 million barrels last week, signaling stronger refining activity, while OPEC+ adhered to production cuts, limiting output to 28.5 million barrels per day despite calls for easing. These constraints amplified price impacts, pushing Brent up 1.5% intraday before profit-taking capped gains.

In the near term, outlook remains cautiously optimistic, with potential upside to $82 if demand sustains and geopolitics flare, though recession risks could cap rallies below $75. (142 words)

📈 Technical Analysis

Brent Oil is currently priced at $61.24, reflecting a modest daily gain of 0.29%. However, it remains significantly below key moving averages: MA21 at $65.11, MA50 at $65.85, MA100 at $66.32, and MA200 at $67.15, suggesting a bearish trend. The price is consistently trading below these averages, indicating weak bullish momentum and a lack of buying interest.

The RSI at 33.59 signals that Brent Oil is nearing oversold conditions, potentially foreshadowing a short-term rebound if momentum shifts. Conversely, the MACD reading of -1.33 reinforces the prevailing bearish sentiment and highlights the potential for continued downward pressure.

Traders should closely monitor the $60 level for support, as a break below could activate further sell-offs. Resistance appears strong at the $65 area. A move above this range, bolstered by improved RSI readings or bullish MACD crossovers, would be necessary to

🔵 Natural Gas

Contract: NGZ25 | Price: $3.70 $/MMBtu (+1.76%)

📰 Market Drivers & News

Natural gas markets exhibited stability today, with front-month futures holding steady around $2.80 per million British thermal units amid a delicate balance of influences. Key drivers included mixed weather forecasts, tempering heating demand in the U.S. Northeast while supporting power sector needs in the South, where surging electricity consumption from data centers and manufacturing is accelerating natural gas reliance. Supply dynamics remain robust, bolstered by record-high U.S. production levels exceeding 100 billion cubic feet per day, though moderated by voluntary output cuts from major producers to stabilize prices. Inventory levels, per the latest weekly report, showed a smaller-than-anticipated injection of 80 billion cubic feet, leaving stocks about 5% above the five-year average and signaling ample reserves heading into winter.

Geopolitically, heightened LNG exports to Europe—driven by persistent supply disruptions from the Russia-Ukraine conflict—continue to underpin U.S. supply tightness, indirectly supporting prices despite global oversupply risks. This has kept price volatility low, with spot prices dipping modestly on mild weather but rebounding on export strength.

Near-term, expect range-bound trading between $2.60 and $3.00, as balanced fundamentals and upcoming maintenance season temper upside potential unless colder snaps or export surges materialize.

(142 words)

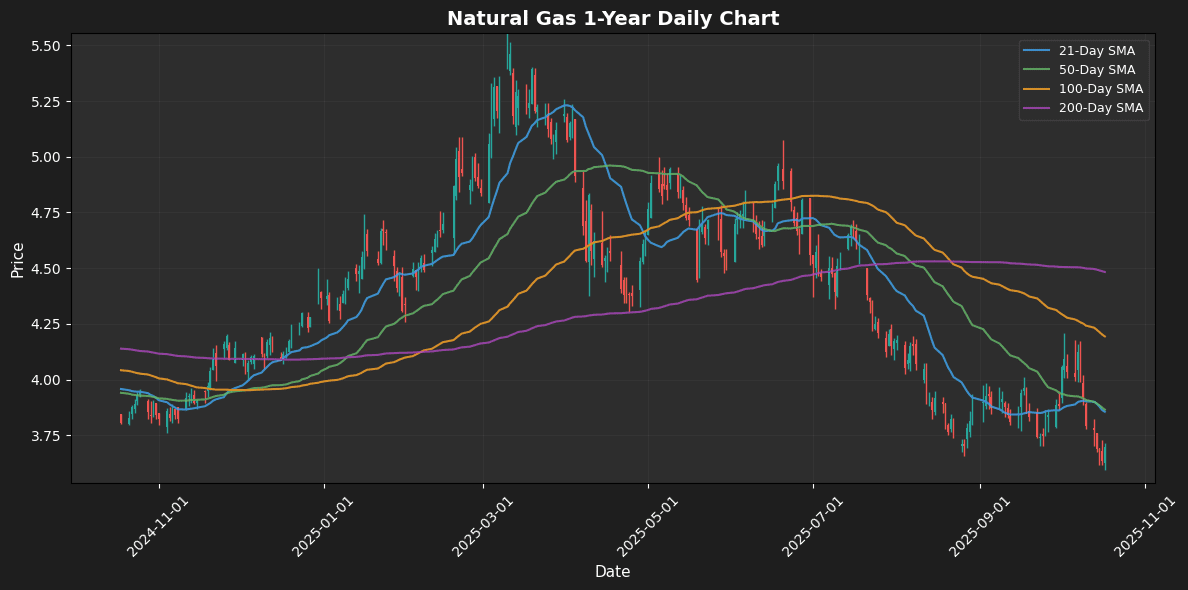

📈 Technical Analysis

Natural gas is currently trading at $3.70, exhibiting a daily increase of 1.76%. However, the price remains below critical moving averages, with the MA21 at $3.86, MA50 at $3.87, MA100 at $4.19, and MA200 at $4.48, indicating a bearish trend in the short to mid-term. The recent price action suggests resistance may be encountered around $3.86 and $3.87, where the MA21 and MA50 coincide.

The RSI reading at 39.72 indicates that natural gas is nearing oversold conditions, but momentum is still weak as suggested by the MACD of -0.06, which also underscores a bearish sentiment. Traders should closely monitor any attempts to reclaim the MA21 as a potential buy signal, while a sustained move below $3.60 could trigger additional selling pressure. Overall, a cautious approach is recommended, waiting for clearer bullish signals before entering positions.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.